Investing for Retirement: Theories and Real-World Strategies That Will Help You Save and Invest for Your Future

If you file your personal taxes on time, you’ll soon be receiving your tax refund in a few short weeks. For many people, getting a refund means they have more money to save and invest for the future.

Do you know what you’re going to do with your tax refund this year?

It can be tempting to splurge on a few treats for your family, but be sure to put some of it aside to help you out on a rainy day or down the line in the future during your retirement.

When it comes to investing and saving for the future, there is a lot of confusion surrounding how much you need to save, and how you should invest it.

Baldip Moore, CPA, CGA, offers a few guidelines you should look at when considering how to save for your retirement.

Follow one of these basic retirement planning theories

There are no hard-and-fast rules when it comes to saving for your retirement. What one family needs will differ from their neighbours and friends — it all depends on your lifestyle, expenses, savings, and so much more. While there are countless factors to consider when deciding how much to save, there are 3 retirement planning theories that offer you a good starting point.

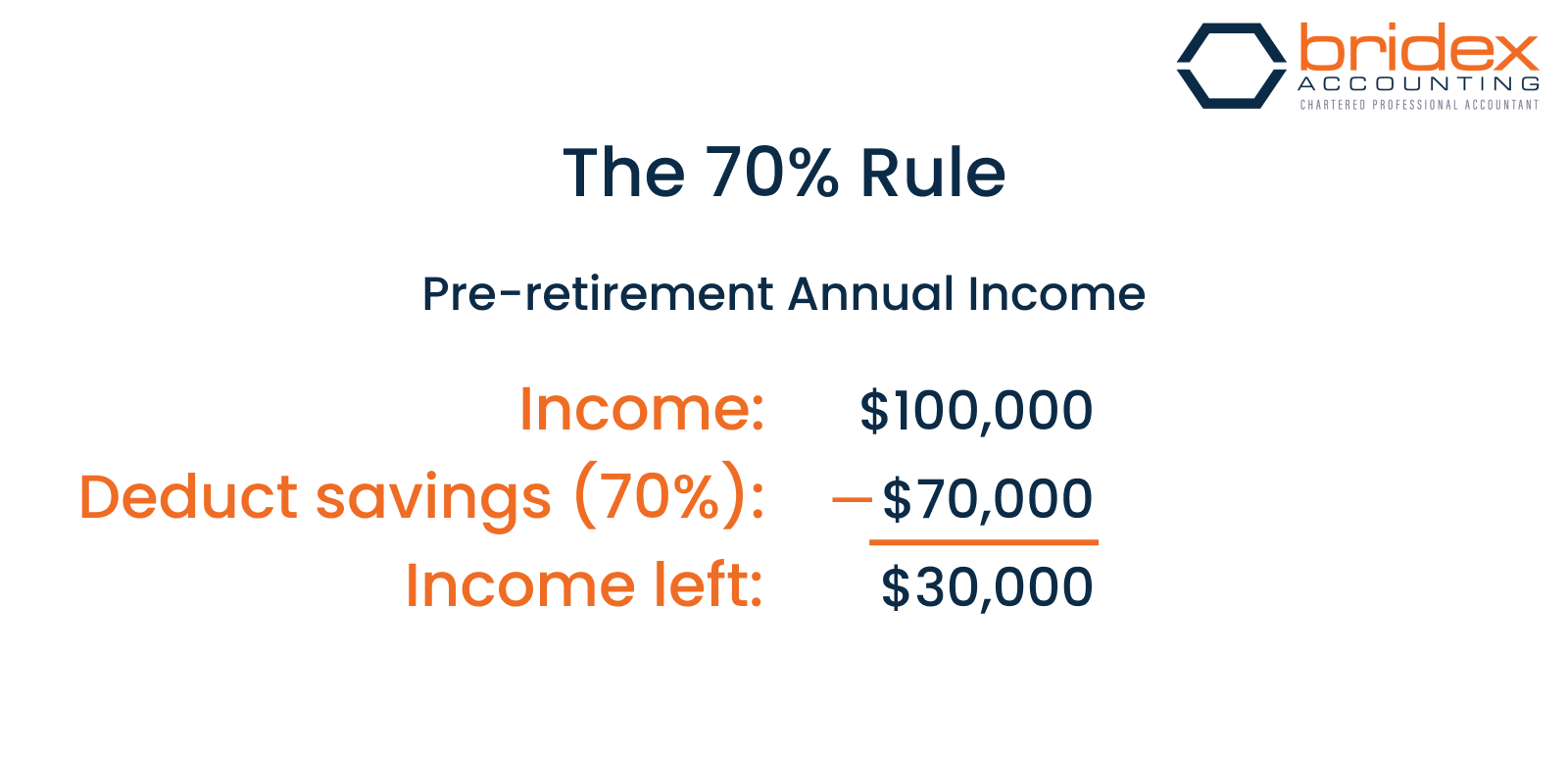

The 70% Rule

This is a common rule that financial planners recommend to people who are figuring out how much to save for their retirement. It suggests that you need to save around 70% of your pre-retirement income for your retirement.

For example, if your pre-retirement annual income is $100,000, then you’ll need to save approximately $70,000 for each year of your retirement.

The reasoning behind this rule is that your lifestyle changes when you retire and you have less expenses for things like commuting, clothing, and other items. While 70% is the name of the rule, it really depends on your lifestyle. The amount you need to save will depend on:

- Whether your mortgage is paid off,

- Whether you still have dependants to support,

- Whether you plan to travel and take vacations,

- Whether you will be spending more time doing hobbies.

These factors can increase or decrease that 70% number, so it’s best to carefully think about what you want your retirement to look like in order to find out what percentage of your pre-retirement income you should save.

The 4% Rule

This rule is a bit more complex than the 70% rule, and depends on the size and diversity of your investment portfolio.

The 4% rule states that you can withdraw 4% from your investment portfolio comfortably without negatively impacting it. As a result, you can count on that 4% of income during retirement.

However, for this rule to be effective, it assumes you have a sizable investment portfolio. In addition, the study behind this theory uses a sample portfolio which is made up of a split between U.S. common stocks and intermediate-term treasury bills.

Your portfolio will likely have a different makeup, and as a result the percentage you can withdraw each year will change as well. Keep in mind that the 4% is a guideline, not a strict rule or recommendation.

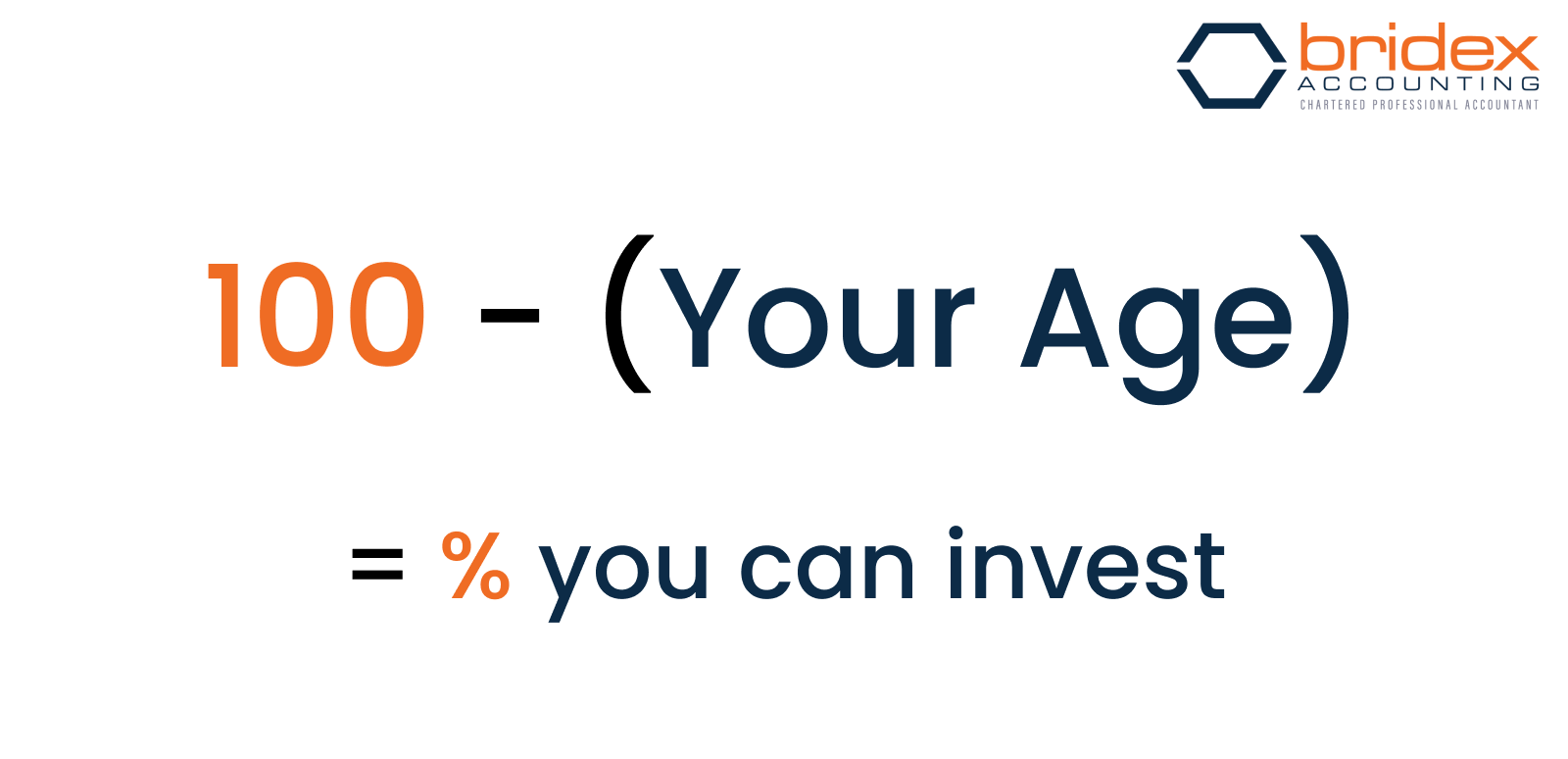

The 100-Minus-Your-Age Rule

This rule is all about your risk tolerance. Ideally, the older you get, the more risk-averse you should be when it comes to your investments — since your portfolio has less time to recover from a downfall if it occurs.

This rule helps you figure out which proportion of your investments should be invested in equities versus safe, fixed-income assets.

For example, if you’re 30 years old, then you can invest 70% of your portfolio in equities, while only 30% need to be invested in fixed-income assets. If you’re 65, then only 35% of your portfolio should be invested in equities, and so on.

Keep in mind that since the life expectancy has increased over the years, and since there is a low return on fixed-income investments, you may want to use the 110-years-minus-your-age rule instead. Keep in mind that this is only a guideline.

Know how much risk you can afford to take

In addition to figuring out how much money you need to save for your retirement, and how you should save and invest it, it’s important to consider your tolerance for risk. Keep in mind that risk is not stationary — it changes during the course of your life. While you are young, you may have a higher tolerance for risk compared to when you’re older.

So how do you figure out your risk tolerance at any given point in time? It depends on two key factors: Your ability to take risk (how financially secure you are), and your willingness to take risk (how you feel about losses).

Once you know what your risk tolerance is, you can look into various investment vehicles for your retirement income. These include:

- Stocks (equities): High-risk investments

- Bonds (fixed income): Medium-risk investments

- Cash equivalents: Low-risk investments

- Life insurance: Low-risk investments

Figuring out how to invest for your retirement will depend on how much money you need to save, how much time you have to save it, and what your risk tolerance is. No two situations are alike, so it’s best to meet with a CPA firm like Bridex to figure out how to structure your retirement plan and your investments to ensure you’re on the right track.

It’s never too early or too late to start planning for your retirement

A major part of planning for your retirement, in addition to ensuring you have a steady income, is figuring out your

estate plan. Be sure to connect with

Baldip Moore, CPA, CGA, to learn more about how to structure your investments so that your retirement is tax efficient and stress free.

No matter which savings theory you’re following or what kind of investments you have, it’s important to know that your portfolio is built on a tax efficiency framework — so you and your loved ones don’t end up paying more tax than you need to on your estate.

CONTACT US

Unit 215 — 5455 152 Street

Surrey, BC V3S 5A5

Canada

LINKS

CLIENTS

Easy and secure file sharing.

Simply drag and drop your financial documents into the client portal. Your documents will be kept confidential and secure. You will receive a confirmation email when Bridex Accounting Services has received the documents.